Homebuilders are on shaky ground this year, but according to one top technical analyst Toll Brothers could be gearing up for a rebound.

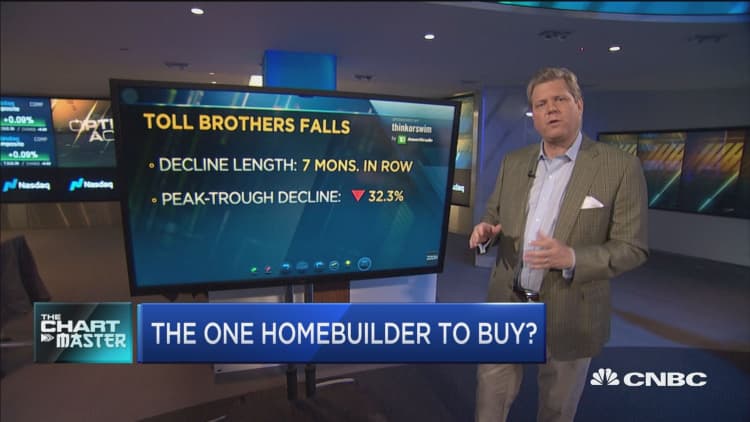

Shares of the Pennsylvania-based construction company have fallen nearly 24 percent since January and are on track for their worst monthly losing streak in history. However, Carter Worth, head of technical analysis at Cornerstone Macro, says there’s something in the charts indicating a big reversal ahead.

According to Worth’s analysis, despite a series of sharp rallies and sell-offs in the past decade, shares of Toll Brothers have consistently thrown back to its 150-day moving average, implying “[the] mean reversion trade has been quite profitable.”

“I’m going to make the bet that this decline is due for some sort of throwback,” Worth said Friday on CNBC’s “Options Action.”

In addition, Worth noted that although the stock has recently broken below its long-standing support at the $40 level, he believes it has found a new bottom around the $35 mark, which it has previously bounced off.

Shares of Toll Brothers are up more than 34 percent in the past two years but have still lagged behind the broader consumer discretionary sector — which is up more than 37 percent in the same time.

Yet according to Worth’s chart work, shares of the homebuilder have started to reverse off a multiyear low relative to consumer discretionary, signaling a potential break to the upside ahead.

“We are literally on the prior low, and I think we’re going to hold,” he explained, “so I want to make a bet it’s so bad it’s good.”

Toll Brothers is down 8 percent in the past 12 months and was trading lower on Monday.